Elon Musk & Masa Son head to Saudi Arabia; China's MiniMax dethrones Character AI in the USA

October Week 5: Oct 29 - Nov 4

In today’s edition:

Elon Musk & Masa Son + TikTok’s & Uber’s CEOs take a trip to Saudi Arabia

America’s Character AI, has been dethroned by China’s MiniMax

Sarvam AI is the newest competitor to OpenAI for India’s 1.4 Billion People

More Asia Startup News

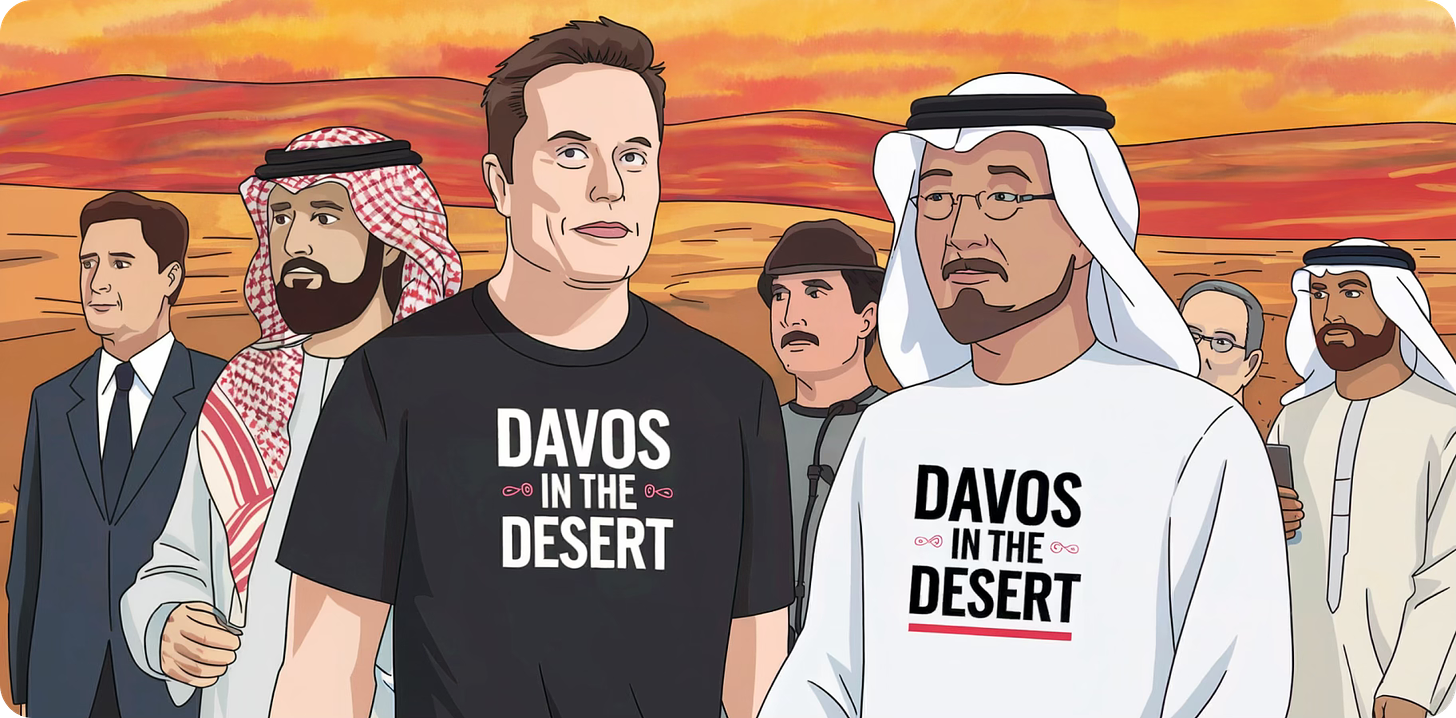

🔥 Elon Musk & Masa Son + TikTok’s & Uber’s CEOs take a trip to Saudi Arabia

The Scoop: Few conferences can gather a more powerful group of finance and tech moguls than Saudi Arabia's sovereign wealth fund, which sponsors the annual Future Investment Initiative, also known as "Davos in the Desert."

This year's conference, held this week in Riyadh, has featured Elon Musk, SoftBank's Masayoshi Son, Ben Horowitz, TikTok CEO Shou Zi Chew, Uber co-founder Travis Kalanick, and a host of CEOs from major firms including Blackstone, Citadel, Goldman Sachs, and Apollo Global Management.

Fun Facts:

During the event, SoftBank Group CEO Masa Son alluded to his next big investment in artificial superintelligence—AI that is much smarter than the human brain—predicting its arrival by 2035. "I had to save some money for the big fight for the big opportunity," he said. "Now I'm saving tens of billions of dollars so I can make [my] next big move."

Also during the event, Elon Musk stated that "By 2040, there will be more humanoid robots than there are people." These robots will retail for about $25,000, he said. "Assuming we are on the good path of AI, I think we will be in a future of abundance."

Why It Matters: The PIF has historically been one of the largest Limited Partners of funds like A16Z, Vision Fund, Craft Ventures, and more. But during the event, Al-Rumayyan, the leader of PIF, announced that the firm would decrease the portion of its international investments to between 18% and 20%, down from 30%.

It’s worth noting, PIF now manages $925 billion, up from $764 billion at the end of 2023. Still, Al-Rumayyan remarked, "There is a big paradigm shift for how PIF is deploying investments" as the firm aims to refocus on its domestic economy.

In summary, we're likely to see PIF continue to invest in the U.S. venture capital funds it's already backed, but the window for VC funds to get major PIF backing for the first time may have closed.

💸 America’s Character AI, has been dethroned by China’s MiniMax

The Scoop: Chinese artificial intelligence unicorn MiniMax, which is funded by Alibaba & Tencent with a war chest of $850 million, has become the mainland's latest social-media star overseas, thanks to its popular Talkie chatbot entertainment app, which lets users have conversations with virtual characters.

Data from market research firm Sensor Tower showed that Talkie – part of the fast-growing "companion AI" market segment – was the fourth most-downloaded AI app in the United States in the first half of 2024, ahead of Google-backed rival Character.ai, which ranked 10th. Character.ai was founded by arguably the world's #1 AI researcher, Noam Shazeer, who now co-leads Google’s DeepMind division.

Fun Facts:

Globally, Talkie recorded 17 million downloads in just the first eight months of the year, and is growing 220% month over month.

MiniMax is expected to take in around US$70 million in sales this year, according to a recent report by The Financial Times citing anonymous sources. The bulk of that revenue is expected to come from the start-up's avatar chatbot platform, which targets the US and other overseas markets.

Companion AI apps are particularly popular among younger users, with those aged 18-35 accounting for more than 70 percent of the user base for top apps like Character.ai, Talkie, Linky AI, and HiWaifu, according to Sensor Tower.

Why It Matters: The first wave of AI apps in the USA were ChatGPT and Character.ai, but China seems to have caught up. Between ByteDance with TikTok (similar to Instagram's Reels), MiniMax with Talkie (similar to Character.ai), and Kuaishou with Kling (similar to OpenAI's Sora), the international competition is on full blast.

🇮🇳 Sarvam AI is the newest competitor to OpenAI for India’s 1.4 Billion People

The scoop: Sarvam AI is an India-based AI competitor to the likes of OpenAI, Sakana AI, and Anthropic. Recently, the company secured $41 million from firms such as Khosla Ventures, Lightspeed, & Peak XV to become India’s Foundation Model leader. Sarvam's platform supports speech-to-text, text-to-speech, and translation across all 22 major Indian languages. The company is positioning its upcoming products as voice first, as it believes this is the user experience paradigm that will ultimately win.

The team:

The Co-founder and CEO is Vivek Raghavan, who holds a PhD from Carnegie Mellon University, and has been in C Suite Executive Roles for over 12 years.

The Co-founder and CTO is Pratyush Kumar, who holds a degree from IIT Bombay, and was previously a top 1% researcher at Microsoft India.

Bull case: Sarvam aims to build at levels 1 through 3 of the AI Stack (Chips, Foundation Models, & Infrastructure). The best comparison to Sarvam’s strategy is looking at what Google has undertaken in building Gemini. First, Google has built custom TPU chips or more specifically ASICs for model training and inference. Second, Google has a massive team of engineers & researchers building foundation models, and lastly, third Google has a hosted Models as a Service (MaaS) offering that allows developers to interact with Gemini through simple, production-ready AI APIs, built on GCP infrastructure.

Sarvam AI's market positioning is also compelling where 90% of India’s new internet users prefer voice over text, and only 10% speak English fluently. Their voice-first, multilingual AI platform targeting 92% of India's population through the top 22 native languages addresses a clear market gap.

Bear case: Google and Meta already offer services in 15+ Indian languages, backed by significantly larger compute power ($11.3B for OpenAI vs Sarvam's $41M). Only 17% of Indians have home broadband (even though cellular service coverage is rapidly growing), limiting complex AI deployment, and Indian users historically spend 30% less on digital services versus the global average.

🇯🇵 Japan NewsSoftBank is launching a new startup campus in Nagoya, Japan's industrial hub, to energize the nation's startup ecosystem. The open campus (it’s a similar concept to a WeWork, but at a much larger scale) is the size of 4 football fields.

Sony has acquired sports motion capture firm KinaTrax for ~$100M. Their technology, already deployed across 75 MLB and NCAA teams, uses video motion technology to improve a hitter’s swing & a pitcher’s windup.

🇹🇼 Taiwan NewsOpenAI is partnering with Broadcom and TSMC to develop its first in-house AI chip. Production begins 2026 at TSMC, while AMD's MI300 chips will bridge the gap for immediate computing needs. Reportedly, the chip is designed for inference only, and OpenAI will continue using Nvidia for AI training workloads.

🇨🇳 China NewsLuckin Coffee, China's largest coffee chain, will expand to the U.S. in 2025, targeting NYC first with $2 drinks to challenge Starbucks. Their initial focus: areas with high Chinese student and tourist presence. This follows their comeback from a 2020 scandal that resulted in Nasdaq delisting and a $180M fine.

🇻🇳 Vietnam News Vingroup, Vietnam's largest private conglomerate, launched a $150M venture fund for tech startup investments, expanding beyond their usual businesses of real-estate, manufacturing, and electric vehicles.

🇦🇪 UAE News MGX, the UAE-based AI investment firm, is exploring investment in Elon Musk's xAI (Grok chatbot developer). xAI is seeking $5B at a $45B valuation.

🇰🇷 Korea News Coupang's Co-founder Chris Koh raised $100M for HRZ Han River, his VC firm focused on Korean tech investments. Coupang is one of Korea’s largest companies - currently serving 18M+ active customers with a $58B market cap.

🇸🇬 Singapore News Singapore’s Universities NUS and NTU, with $50 million in backing from the National Research Foundation, are launching National GRIP, a venture fund & accelerator program aimed at creating startups from local universities and research institutes. The initiative aims to produce 300 startup teams by 2028.